Future Business Leaders

Dr Ozgur Duymaz

Dr Ozgur Duymaz- 28 November 2020, Saturday

Business leaders play the most important role in determining the strategic goals of companies and making sure that the ship is on its correct course. At this point, the continuous development of business leaders directly affects the organization. So where is the rapidly changing environment going and how will the business leader adapt to it?

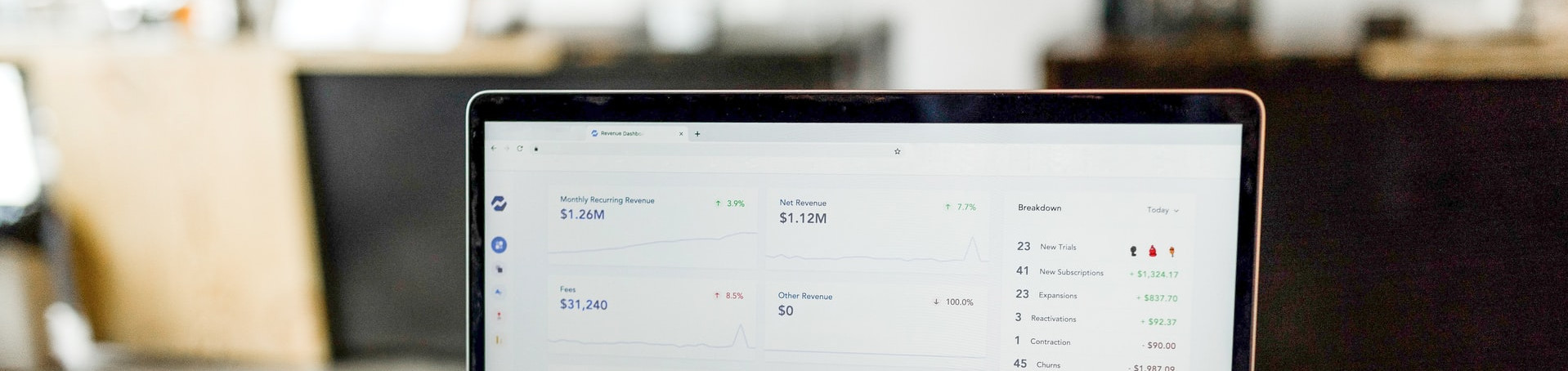

We all see that the world is rapidly adapting to digital technology. In the not too distant future, all data will be transparent in common formats in a digital environment, reports and analysis will be prepared with a single click, even additional analysis that we are unaware of at the moment but may be useful with the help of advanced artificial intelligence, potential decisions we make in the light of this analysis and possible financial and non-financial results will be in front of us.

Let's give an example about the audit profession. Currently, audit companies are testing documents and data subject to the financial statements by sampling, making many accounting adjustment records, and rearranging the financial statement in accordance with the determined accounting standards such as; IFRS. Needless to say, this process can sometimes take weeks.

Let's think of a world as follows: All the data of the audited company is stored digitally in a data warehouse in a certain readable format, and a program scans and reads this data, analyzing it and taking into account the nature of the business and reports it in a predefined format, and even evaluating the developments in the digital environment and If it sees some related deficiencies, it offers solutions. This scenario can be applied to many other areas, as long as there are no obstacles to our imagination.

So, what jobs will CFOs do in such a digitalized world, or does an organization need both CFO and CEO? Can CFOs evolve into CEOs using the benefits of their financial backgrounds, or will CEOs need to strengthen their financial knowledge?

Imagine two intersecting sets as taught in elementary school, one representing the role of CFO and the other representing the role of CEO. The areas where they intersect have common duties and responsibilities. As the days pass, the two clusters are getting closer to each other and therefore the area where they intersect is expanding. It looks like these two clusters will become one cluster in the future.

I think that in the future, professionals with financial backgrounds will become CEOs more often. Perhaps in the future, one person will hold the positions of CFO and CEO in many organizations. Imagine what will happen in the distant future.

Organizations such as ACCA, IMA, and AICPA, who issue certificates in accounting and finance, are constantly updating their exam content as they realize that such a transformation is happening. They have seen that in addition to training accounting and finance professionals they are also training future leaders. Recently, both those who have taken the exams organized by such organizations and those working as CFOs have definitely encountered the following issues.

- By analyzing the position of the product in the market, developing a pricing strategy, and basing it on a financial model, as well as ensuring long-term profit maximization. Analyzing the effect of providing new features to the product on the price and cost

- Defining, analyzing, and prioritizing the risks that will affect the achievement of the strategic goals of the company known as enterprise risk management, with a holistic perspective and taking the necessary measures to reduce the possibility of negative consequences.

- Making some strategic decisions, for example, should we produce or buy? What the effects are of sunk and fixed costs on this decision? Or shall we stop the production at a certain point and sell it as a semi-finished product or continue production and sell it as a final product?

- What can be done to reduce the weighted average cost of capital? How should the debt-capital composition be? How should net working capital management be managed?

- How should data governance be managed? How can we benefit from big data?

- What should be done to improve business processes, and where to start, how can activities that do not add value to the product be minimized? What should be done in order to minimize the activities that you cannot add to the price of the product and that will not harm the continuity of the business?

- Are financial indicators sufficient to evaluate the performance of an organization or are non-financial indicators also need to be used? Which KPIs can be used to measure customer satisfaction and the efficiency of internal processes?

- How can potential investment be evaluated in all aspects by using PESTEL, i.e. environment and SWOT Analysis in investment decisions?

What should be done to embed the ethical culture into an organization? For example, when an investment is undertaken in another country, how can the ethical culture of the main institution be embedded in this investment unit as a best practice?

How do we measure the goals of the departments in line with the company's mission and vision?

Whose duties and responsibilities fall under the above mentioned issues? Can't those who work as CFOs perform these tasks? Or does an organization need a CFO when there is a well-trained CEO?

While technological developments affect business life to this extent, humans will continue to be the most important part of this world as a decision-maker. At this point, I believe that professionals who have the strong financial knowledge and are prone to use and benefit from new technologies and who make continuous development of a life philosophy will adapt to this change more quickly and in doing so thrive in business leadership.

Access to information has never been easier and cheaper and the only obstacle to learning is ourselves.